Discover the True Cost of College

There’s more to it than just tuition.

Saving for college starts with understanding the true cost of a post‐secondary education. College expenses grow every year and include more than just tuition. Over the last 10 years average inflation-adjusted tuition and fees declined by 4% for public four-year in-state students.

Scroll down to see the national averages for one year at an in‐state public university in 2024-2025.

The Cost of One Year of College

There’s More To It Than Tuition

Tuition

$11,950

Room and Board

$13,900

Books and supplies

$1,330

Transportation*

$1,380

Other Expenses

$2,430

Total

$30,990

This is the average total cost of college for a full‐time, in‐state student at a public four‐year university.

*Please note, transportation and travel costs are not qualified expenses for 529 plans, they will be treated like ordinary income: state and federal taxes will apply, with a 10% federal penalty for withdrawals from your 529 plan used to pay for them.

Source: Trends in College Pricing and Student Aid 2025, College BoardGrants, loans and scholarships are harder to come by.

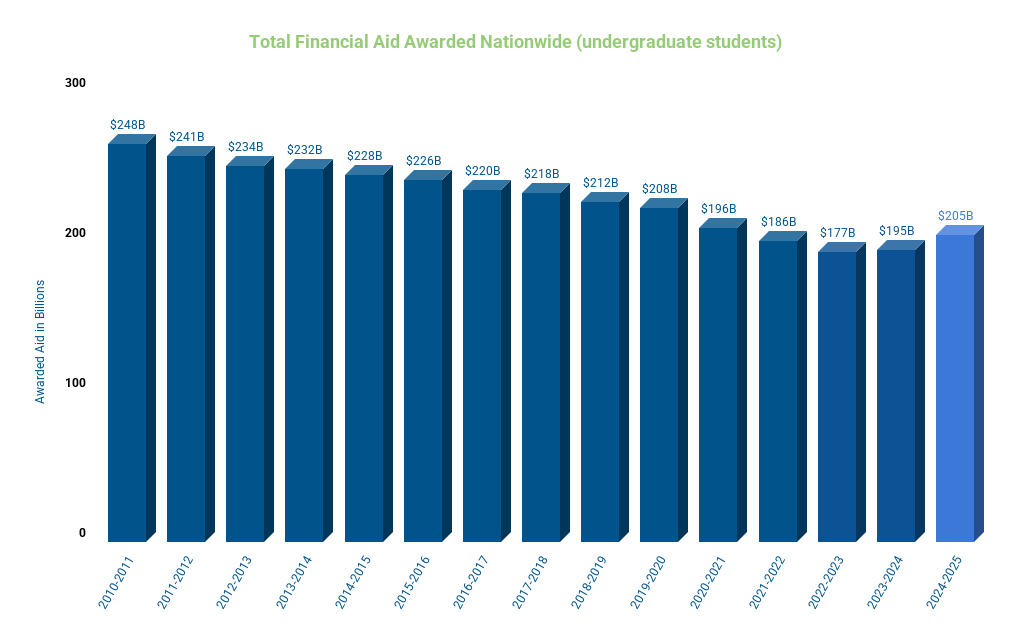

While costs continue to increase, financial aid has been decreasing.

Total financial aid for undergraduate students peaked in 2010-11 at $258.7 billion (in 2023 dollars) and declined to $190.1 billion in 2023-24.

Note: Percentages may not sum to 100 because of rounding.

Source: Trends in College Pricing and Student Aid 2024, College Board

Grants, loans and scholarships are harder to come by.

While costs continue to increase, financial aid has been decreasing.

Since 2010, annual college costs have increased 15% while available financial aid has decreased 12%.

- Sources:

- Trends in College Pricing 2019, CollegeBoard, 2019

- Trends in Student Aid 2019, CollegeBoard, 2019

Your Savings Can Grow Faster

Learn about the compounding effect of 529 tax benefits.

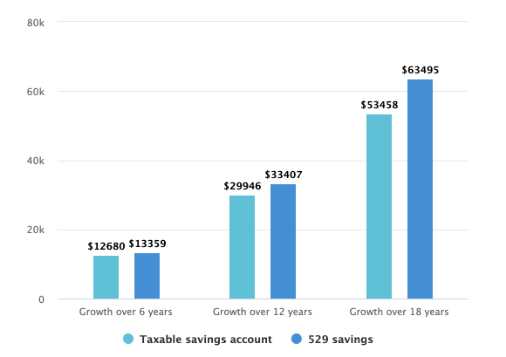

Taxable savings account vs. 529 savings

Two different families open savings accounts with an initial deposit of $1,000 and opt for monthly contributions of $150. Both families save for 18 years, earning 7% on their investment.

The 529 plan earned over $10,000 more over 18 years than the taxable savings account.

These hypothetical examples are for illustrative use only and do not reflect an actual investment in any specific 529 plan. Families are assumed to be in the 24% tax bracket during contribution and distribution. The hypothetical examples assume a monthly contribution of $150, return on investment of 7% and no withdrawals during the 18 years. Actual returns may vary.Understanding the 529 Tax Landscape State by State

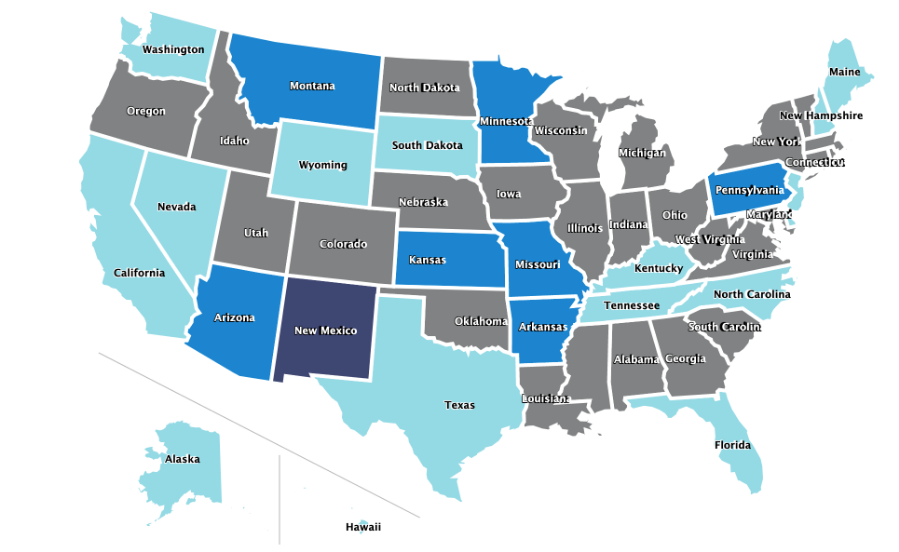

Get the most out of your state tax benefits.

Home of The Education Plan

Tax parity*

These states offer tax deductions or credit for contributions to any 529 plan, regardless of state.

*Please Note: State tax benefits in tax parity states apply to contributions in any 529 plan.

Tax neutral

These states do not offer tax deductions or credit for 529 contributions, or have no state income tax.

In-state tax benefit

These states offer tax deductions or credit for contributions to the

in-state 529 plan only.

529 Plan tax benefits by state, as of January 2024

The Benefits of Starting Early

No matter your educational path, 529s can help with the journey.

Planning ahead is the key.

| Start Early | Consider contributing once your child is born rather than when they’re already at school age. |

| Make it a family affair | Get help from friends and family to ensure you’re meeting education milestones. It’s an excellent legacy planning opportunity. |

| Consider higher contributions | Maximizing your contributions can ensure that you have enough to fund any educational needs. |

| Ensure your investment strategy is aligned | Choose an age-based solution or a custom investment solution based on your needs. |

Don’t let the sticker price scare you. Most students will receive grants and other benefits to help pay the bill. The remainder can be covered with traditional savings, student loans or a 529 account, which has significant tax benefits and can be opened with as little as $1.

Research has shown that children with savings of just $500 are three times more likely to attend and four times more likely to graduate college. You got this. Get started today.

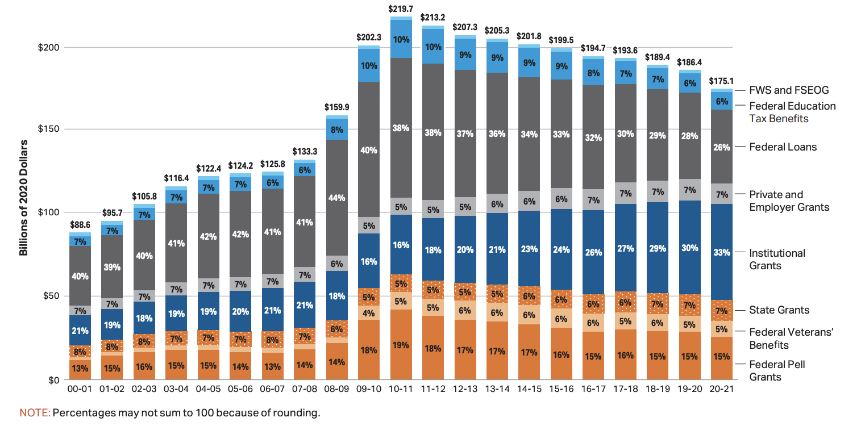

What Financial Aid Typically Covers

Grants, loans and scholarships are harder to come by.

While costs continue to increase, financial aid has been decreasing.

Between 2010-2011 and 2020-2021, average total financial aid per undergraduate student decreased by 8%.

Total Undergraduate Student Aid in 2020 Dollars by Source and Type (in Billions), 2000-01 to 2020-21

Source: https://research.collegeboard.org/pdf/trends-college-pricing-student-aid-2021.pdf

The Tax Benefits of Saving Early

Your Savings Can Grow Faster

Learn about the compounding effect of 529 tax benefits.

Taxable savings account vs. 529 savings

Two different families open savings accounts with an initial deposit of $1,000 and opt for monthly contributions of $150. Both families save for 18 years, earning 7% on their investment.

The 529 plan earned over $10,000 more over 18 years than the taxable savings account.

These hypothetical examples are for illustrative use only and do not reflect an actual investment in any specific 529 plan. Families are assumed to be in the 24% tax bracket during contribution and distribution. The hypothetical examples assume a monthly contribution of $150, return on investment of 7% and no withdrawals during the 18 years. Actual returns may vary.

Understanding the tax landscape

Get the most out of your state tax benefits.

Updated as of 11/23/2020Home of The Education Plan

These states offer tax deductions or credit for contributions to any 529 plan, regardless of state.

These states do not offer tax deductions or credit for 529 contributions, or have no state income tax.

These states offer tax deductions or credit for contributions to the

in‐state 529 plan only.

Tax Benefits by State by State

In-State Tax Benefit

These states offer tax deductions or credit for contributions to the in-state 529 plan only.

New Mexico

Home of The Education Plan

Tax Parity

These states offer tax deductions or credit for contributions to any 529 plan, regardless of state.

*Please Note: State tax benefits in tax parity states apply to contributions in any 529 plan.