Received a 1099-Q? See our FAQs for additional information.

Cheers to 30 Years of 529 Plans

For 30 years, 529 plans have helped families save for future education and invest in what’s possible. The Education Plan is proud to celebrate this milestone, and to support families as they plan for the future.

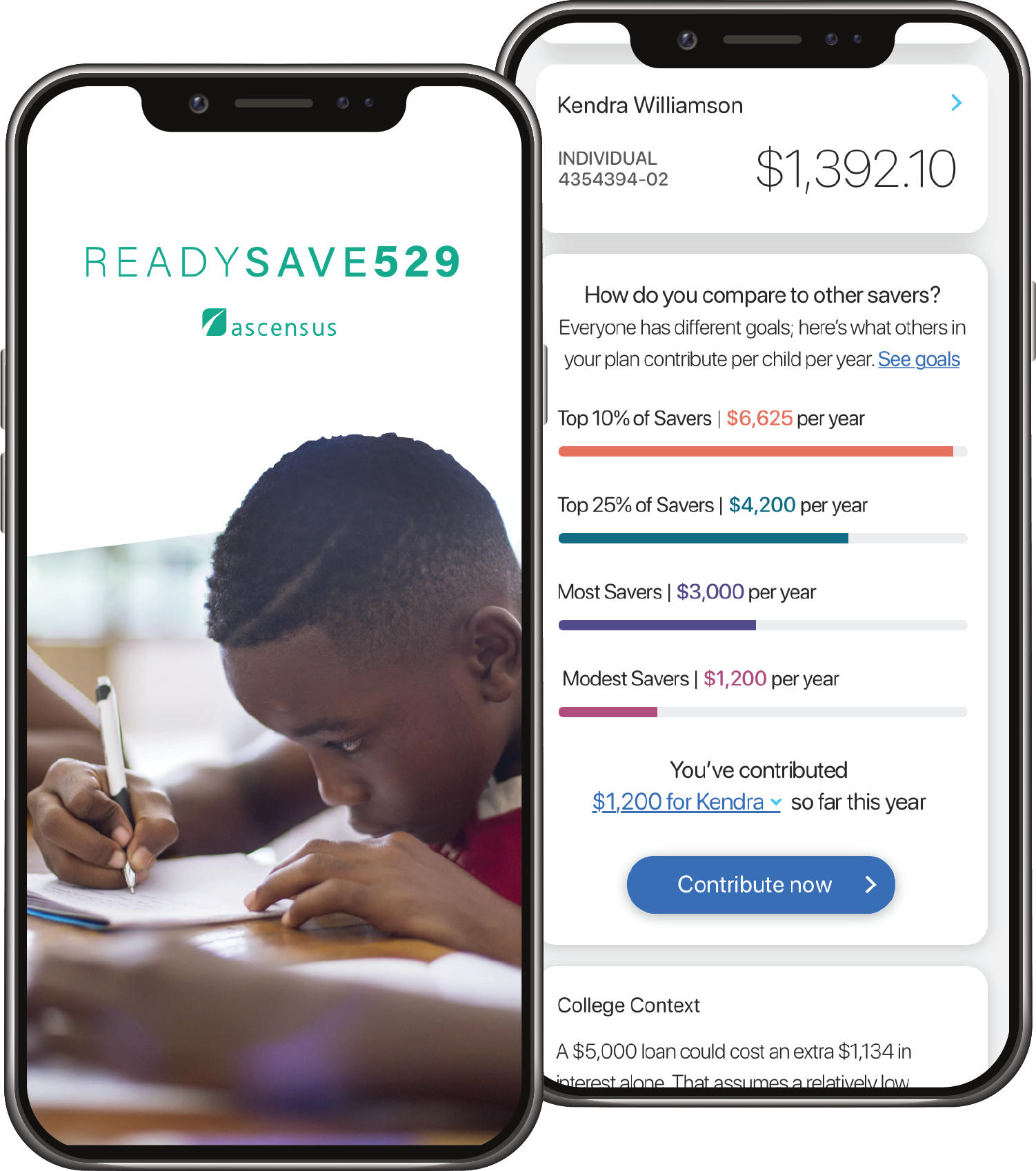

Now there's an even easier way to access and manage your account with The Education Plan: the Ready Save 529 mobile app.

The Ready Save 529 mobile app puts your education savings at your fingertips with convenient and easy-to-use features.

- Check your balance

- Make deposits

- Review your investments

- Automate contributions

- Get guidance to keep your savings goals on track

We're excited to bring you this new tool to help you save even more.

School’s In For Summer

This summer, save smart with a 529 plan and set the stage for their future success.

Start Saving

Everything You Need To Know About The Education Plan

Discover how a 529 college savings plan can help your family save more for higher education in this short video.

The 529 Learning Center

Whatever the path, begin with a plan. The Education Plan’s 529 Learning Center

offers families tips on saving for future education, strategies for maximizing your account

and much more.

529 News

Who Is The Education Plan For:

FOR FAMILIES

The Education Plan makes it

easy for families to save more

for educational expenses.

• Tax-advantages

• Covers many expenses

• Anyone can open an account

• Only $1 minimum contribution

FOR EMPLOYERS

Adding The Education Plan to

your benefits package is a no-

cost way to support employees.

• No cost to employer

• Potential tax benefits

• Easily enhance benefits package

• No fiduciary responsibility

FOR FINANCIAL

PROFESSIONALS

Help clients build a thoughtful

educational investment portfolio

with The Education Plan.