Gifting & Rewards Programs

The gift that never gets outgrown, broken or forgotten.

So many gifts end up being played with for a day and then forgotten. The Ugift program makes it easy for friends and family to give a gift that can make a lasting difference in your loved one's life. A contribution of as little as $25 can significantly lessen their debt load in the future. (Bonus: It gives you an easy to answer to all those, “What should I get her?” questions.)

Sure, a kid may not think the gift of education is the coolest thing to unwrap today. But they’ll think you’re super awesome when they unwrap their future achievements without as much debt!

Already an account owner with The Education Plan? Visit your account now to generate your Ugift code.

LOGIN TO MY ACCOUNT

Top 5 Reasons to Set Up Gifting For Your 529 Plan:

1

It's a meaningful gift that can last a lifetime

2

Anyone can contribute at any time with as little as $25

3

It can be a one-time gift or recurring through UGift

4

It may offer tax benefits for the gift-giver1

5

Even a small gift can make a big difference with compounding interest

Easy Gifting with Direct Deposit

You can set up automatic recurring gift contributions from your bank account or, if your employer participates, directly from your payroll. Log in to your account to get started.

Gifting with The Education Plan and Ugift

LOGIN TO MY ACCOUNT

Ugift is an easy, free-to-use service that lets family and friends contribute to your account with The Education Plan. Saving for that degree or certification can take a village, and Ugift makes it easy to get help from your network of loved ones. Instead of giving toys, cash or other typical gifts that are used too quickly or outgrown, gift-givers get the satisfaction of knowing that their generosity can make a lasting difference. To learn more, visit ugift529.com.

A gift contribution to a 529 plan is a great idea for any occasion, particularly for birthdays, holidays, baby showers and graduations. With gift contributions going into a plan from a few different people a few times a year, education savings can really add up significantly.

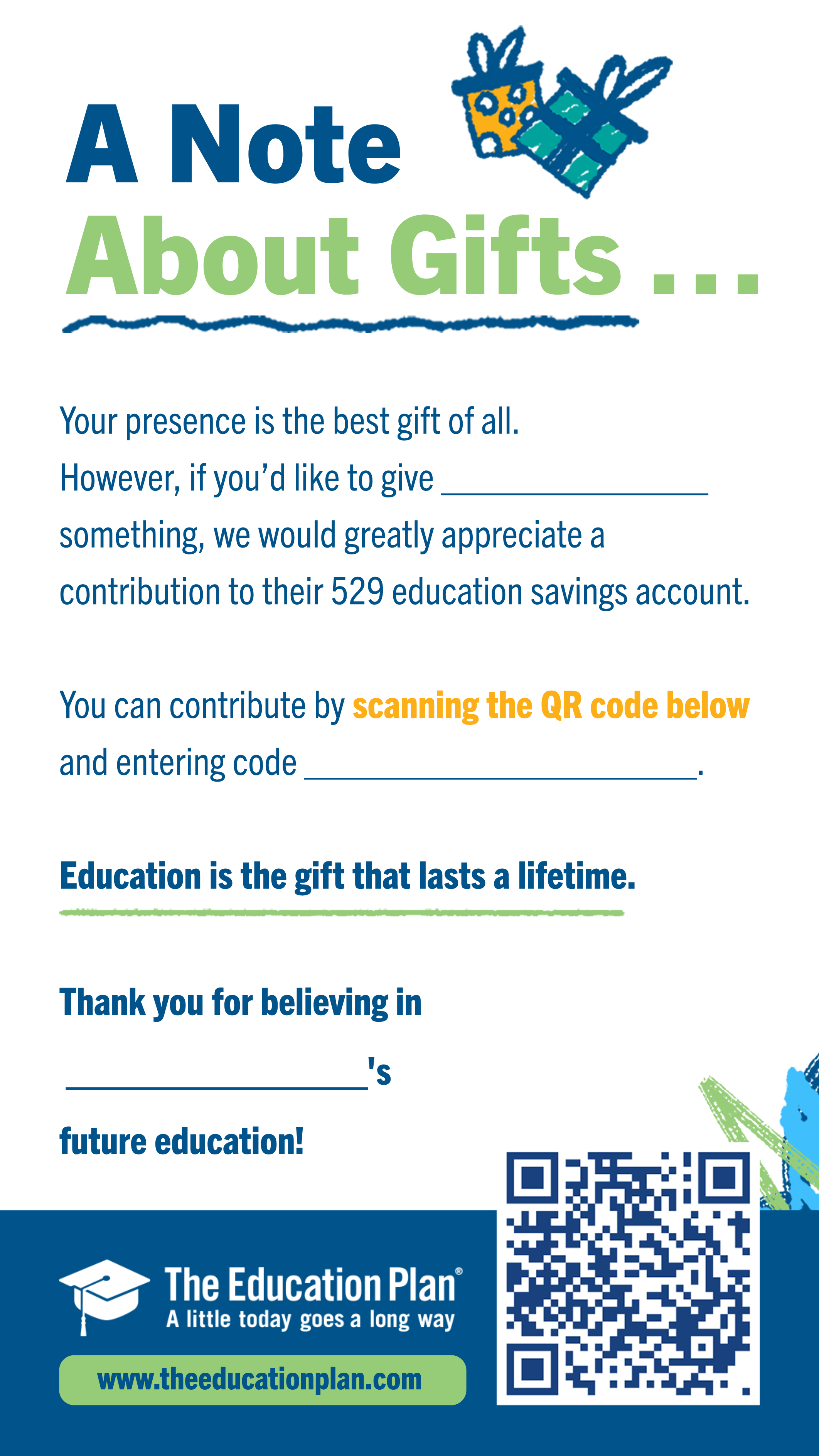

Setting up your 529 account to accept gifts is easy with Ugift. The system will generate a unique code you can share with loved ones to make gifting into your child’s 529 simple. Just follow these steps to create your code.

LOGIN TO MY ACCOUNTGive the Gift of Education!

Download and print a certificate for holidays, birthdays and special occasions.

Get the Gift of Education!

Download and print these gift cards to share with friends and family, making it easy for them to contribute to your child's future.

Boost your future education and college savings with Upromise®

Upromise is a free service that helps families save for college with cash back rewards from everyday activities such as online shopping, dining, grocery shopping, purchasing gift cards and more. Rewards are automatically deposited as contributions to your [The Education Plan] account when you reach $50 in rewards.

Join Upromise for free today:

• Get $5.29 in bonus rewards when you open a new Upromise account.

• Get an additional $25 in bonus rewards when you link your first [The Education Plan] account to your new Upromise account.

• Get additional rewards continuously by shopping, dining, answering surveys and more from your favorite stores and restaurants.

• Link your Upromise account to your 529 plan account and you are automatically entered into the monthly Upromise 529 Scholarship drawing of five $529 scholarships.

Learn more at Upromise.com. It's fast, easy, and secure.

Disclosure

Upromise is an optional service, separate from The Education Plan, and not affiliated with the state of New Mexico. Specific terms and conditions apply. Participating companies, contribution levels, and terms and conditions are subject to change at any time without notice.

Upromise and the Upromise logo are registered service marks of Upromise, LLC.

1. Increase to the Federal Annual Exclusion for Gifts. As of January 1, 2025, the federal annual gift tax exclusion increased to $19,000 for a single individual, and $38,000 for married couples making a proper election. For 529 Plans, contributions of up to $95,000 for a single contributor (or $190,000 for married couples making a proper election) can be made in a single year and applied against the annual gift tax exclusion equally over a five-year period. For additional information about potential gift tax consequences, please refer to the Plan Description.